Introduction: The Global Trade Shake-Up and Your Golf Gear

The recent trade wars and tariffs have posed problems for the golf industry. The tariffs placed on imported golf equipment will most likely result in golf consumers paying more and manufacturer profits being cut.

With the implementation of the new trade policies, golfers will soon start noticing increases in expenditure on everything ranging from clubs to golf clothing.

For all parties connected to the sport, understanding the implications of these tariffs would be important. These increasing costs will most likely alter consumer purchasing habits at stores, thus creating a change in the golf industry.

Apart from absorbing the costs, golf equipment manufacturers will have to implement some new strategies to remain competitive.

From the perspectives of business owners, the developing scenario is one worth following closely in terms of the future consequences these tariffs could have on the golf industry.

The choices made in today’s scenario will determine the cost of golf equipment in the upcoming years.

Table of Contents

Tariffs in Focus: What’s Changing?

Key Tariffs Imposed:

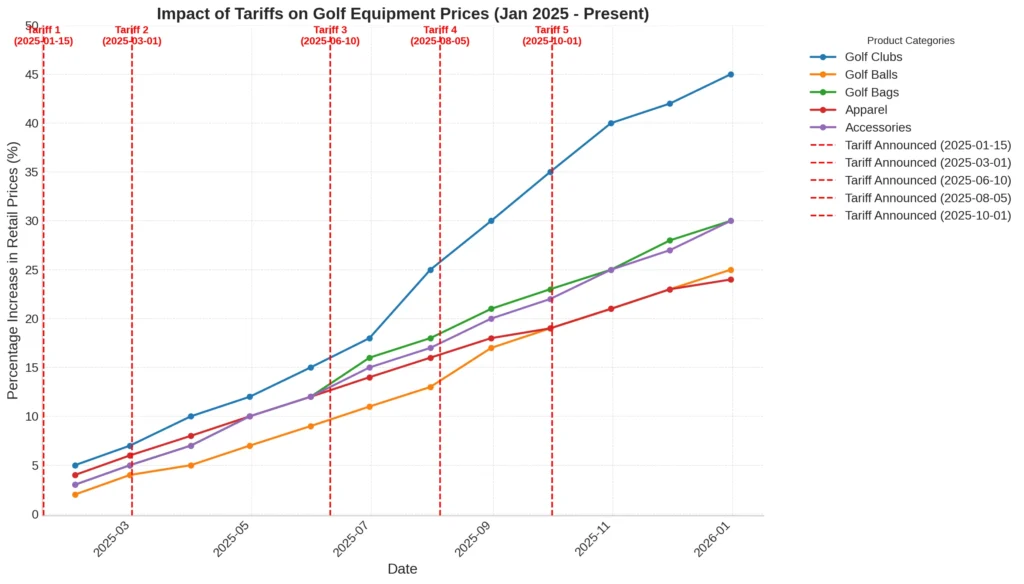

The onset of tariffs has radically transformed international trade, notably in the case of golf equipment.

As its name indicates, the 10% Base Tariff is now levied on numerous imported articles. Such a tariff is also known as a flat rate tax, and its collection can hurt both producers and buyers, resulting in inflationary pricing in the market.

In addition, these goods face a much higher tariff of up to 125% for certain imports from China. This applies most directly to golf equipment because China provides a large number of club parts, including heads, shafts, and grips.

The extra expense of these components will force retailers to adjust their prices and in turn, erode the profit margin of the gadget’s wholesalers.

Impact on Golf Equipment:

Golf Clubs: The fiscal burden is now borne chiefly by manufacturers of golf equipment because of the higher range of tariffs on imported parts from China, Vietnam, and Taiwan.

This will eliminate competition because many people will change their economic behaviour, and the end result will be very few players in the market.

Apparel & Accessories: Products such as golf shoes and gloves have been impacted by tariffs due to imported components. Growing taxes on synthetic cloths, rubber, and leather are going to increase the cost of accessories, which will reduce consumer options and increase pricing.

Price Projections: What To Expect And More:

Expect A Price Increase Of:

Should Clubs: Prices for golf clubs are in expectation of an increase of about 10-20%, which arises from some tariffs placed on imported materials and parts. One important factor for raising prices is the 25% tariff on steel and aluminium imports, which heavily fuels the production cost for golf clubs.

Brands may raise prices on their items to cover the costs of spending high on raw materials, especially when the competition is in steel and aluminium.

Apparel & Accessories: The price of golf apparel and accessories will most likely see increases in the range of 5-15 per cent. Breathtakingly, those valued prices will increase as always in the name of protection for the key importing countries.

In this case, those tariffs mean greater spending on sourcing materials range fabrics, rubber, and plastic used in making clothes and other accessories. At the end of the day, it is these people who the economy will suffer; it’s only a matter of time before the tariffs will impede production.

The Impact On The Consumer Will Be:

Temporary: In the short run, value is sure to drop, and with uncertainty set in, brands will bound budding prices for goods coming into the new markets because of the tariffs rising put a strike under. The new tariffs mean adding to the expenses of the imported goods, which are paid fees most optimally at the cost of people, above consumer expectations.

It is clear that a rocketing increase in the pricing of golf sets, apparel, and accessories from branded stores of golf merchandise use is due to a hike in expenditure caps as per flaunted rough competition in import payments.

Long-Term: If the tariffs continue for an extended period of time, there will be a prolonged and sustained impact on consumers in these sectors by making premium payments.

Put simply, the manufacturers are likely to keep prices elevated in the long term because of large ongoing import costs due to tariff pressures.

Price Projections: What To Expect And More:

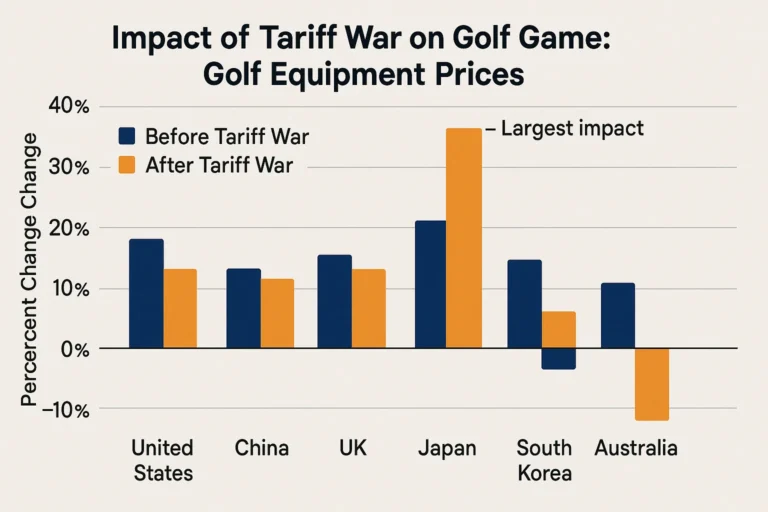

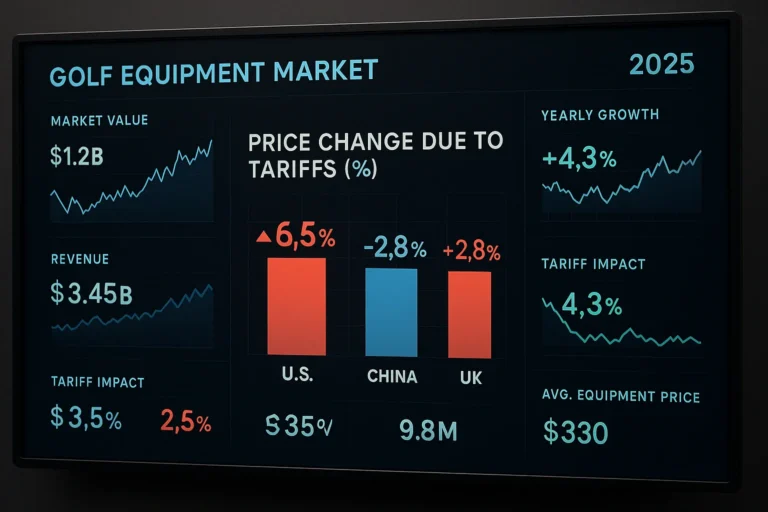

Several issues are affecting the global golf equipment market. What trade relations exist internationally and what level of competition is present are vital to understanding the impact of these dynamics on the price and supply of golf products.

International Trade Relations:

Wider agreements and specific tariffs impact the golf equipment market for a reason. Increased tariffs on imports may worsen the prospects for the clients. For example, if clubs and balls face tariff barriers, then the manufacturers will have to incur these additional costs.

Trade relations that are usually considered friendly tend to have lower prices and more readily available golf equipment. As an example, a country that possesses free trade agreements would be able to import goods without incurring additional duties, making them competitively priced. This certainly is opposite when relations start getting strained, as these could lead to delays and issues with the supply chain, stock levels, and ultimately the choices available for the consumers.

Market Competition:

The direction of the golf equipment market, both at the international and domestic levels, is determined by competition. Dominating players in the market include Callaway, TaylorMade and Ping.

The moment these companies start spending on research, new technology and innovations, golfers will resort to leasing sophisticated tools aimed at product performance enhancement.

Due to higher tariffs, smaller companies may have difficulty competing because of greater manufacturing costs. This scenario may result in additional market consolidation as smaller firms merge with larger corporations to ensure their survival. The breadth of brands gives the customers choices, but can be a double-edged sword in aiding one’s decision-making on which piece of equipment is appropriate.

These behaviours allow consumers to strategise effectively when it comes to the prices and availability of products.

Response from the Industry: Changes in Response to Tariffs

Actions of the Suppliers:

Change in Supply Sources: In seeking to alleviate the adverse impacts of tariffs, numerous manufacturers have been relocating their production activities to countries with lower tariff rates. By reconfiguring their supply chains, manufacturers can mitigate reliance on high-tariff countries and manage cost escalations. This method aids in controlling the financial repercussions that tariffs impose on manufacturers while ensuring production continuity.

Cost Absorption: Due to the prevailing tariffs, some brands have opted to absorb the incremental costs rather than increase prices, thereby maintaining their competitive stance in the market.

This policy enables manufacturers to strengthen customer loyalty and defend their interests from rival traders whose goods are priced lower. While losing some profit, embracing costs is better for defending market share.

Price Adjustments: Alternatively, some brands have chosen to increase the selling prices of specific items to offset the rising costs of product manufacturing. The extent to which the tariff increases factor into a brand’s decision to adjust its prices is determined by the magnitude of the increases and the internal pricing system of the business.

Consequently, consumers may face increased prices for certain products, such as golf club sets and apparel, due to these shifts.

Retailer-Specific Actions:

Inventory Issues: To avoid further increases to the already high costs of inventory, these sellers have started lowering their order quantities prior to the implementation of new region-wide tariffs set to increase prices of certain goods and services.

They do this by ordering a sufficient amount of inventory at the lower value prices in advance of the new region-wide tariffs coming into effect.

Promotions: These sellers provide price markdowns for stores which seek to make purchases of current stock items for resale, further intending to ensure their inventory is cleared off before the expected period of price hikes.

Promoting clearance sales before the price increases helps attract new customers and mitigate the chances of inventory wastage.

Before and After Tariff Price Comparison Table:

| Product Type | Pre-Tariff Price | Post-Tariff Price | Price Increase |

|---|---|---|---|

| Golf Clubs | $500 | $550 | +10% |

| Golf Balls (Dozen) | $30 | $33 | +10% |

| Golf Apparel | $60 | $69 | +15% |

| Golf Shoes | $120 | $138 | +15% |

| Golf Bags | $150 | $165 | +10% |

| Golf Gloves | $20 | $23 | +15% |

| Golf Hats | $25 | $28 | +12% |

| Golf Rangefinder | $250 | $275 | +10% |

| Golf Tees | $5 | $6 | +20% |

| Golf Cart | $3,000 | $3,300 | +10% |

Conclusion: Staying Ahead in a Changing Market

The situation golfers find themselves in is quite dire, given the recent restrictions placed on the import of golf equipment. With tariffs placed on imports of goods, the cost of production of different items like golf clubs, apparel, and accessories has gone up tremendously.

A good example is golf clubs, which have had their prices inflated by almost 10%, and Statement Shirts have not been left behind as they have also seen an increase of about 15%.

As is the case with most new policies initiated, these tariffs are bound to have lasting implications, and consumers will need to be vigilant as price increases for necessities will become more constant.

Golfers need to be savvy with their spending and, if possible, purchase before the full price increases are enacted to lower their expenditure. Adapting to the expense needs to be coupled with learning how to manage tariffs to not be caught in the crossfire of the ever-changing economy..

Frequently Asked Questions:

The sports goods industry and the golf equipment industry suffer significantly from tariffs. Not only do these policies increase prices for consumers, but they also impact the market in one way or the other.

In what ways may import duties impact the golf and its equipment?

Duties on imports may escalate the cost of golf equipment. When manufacturers face increased operating costs because of tariffs, they tend to retail at higher prices. Subsequently, this impacts demand negatively since golf gear will become out of range to a number of players.

In what ways do trade tariffs impact the sports goods industry?

Trade tariffs undermine the entire sports goods industry by increasing the costs of everything. Equally, manufacturers will have to increase their prices on equipment, attire, and even add-ons. Such a scenario causes reduced demand and alters the way businesses set and source their prices.

Should consumers expect an increase in prices for golf gear owing to some altered policies?

Consumers should expect an increase in prices for golf gear owing to some altered policies. Typically, these policies shift most of the burden to manufacturers. Consequently, as suppliers struggle to cope with the costs of importing goods, there is a simultaneous increase of goods in the market. So golfers within the enthusiasts class would have to incur additional expenditure.

What will be the advantages and disadvantages that come with tariffs on golf merchandise?

One advantage of imposing tariffs is that domestic manufacturers are more protected. However, the main disadvantages include higher prices for consumers and a lower selection of products in the market. This makes things difficult for both the golfers and the retailers.

What are trade tariffs, and how do they affect international business relations?

Trade tariffs are taxes paid on goods and services that are imported. Their main goal is to defend the local businesses by increasing the pricetag on international goods. This can warp relationships with other nations regarding the trade of goods and the transfer of products between them.